The automotive industry in Europe was hit hard by the Great Recession. The car sales fell in every year from 2008 until 2012. The whole market shrank by 22.4 percent compared to 2007. The first half of 2013 did also not look good as registrations fell by 6.6 percent. Today, ACEA published the car registrations for September, and the situation seems to have improved significantly.

The automotive industry in Europe was hit hard by the Great Recession. The car sales fell in every year from 2008 until 2012. The whole market shrank by 22.4 percent compared to 2007. The first half of 2013 did also not look good as registrations fell by 6.6 percent. Today, ACEA published the car registrations for September, and the situation seems to have improved significantly.September was the third month this year with with higher sales than the year before. The sales increased by 5.4 percent. The best part of the news is that the program countries Spain(28.5 percent), Greece(10.1 percent), Ireland(27.9 percent), and Portugal(15.9 percent) all started to improve significantly. Cyprus was down 25.5 percent, but that was to be expected. For the first nine months this means that the whole market is still down but only by 3.9 percent, because the third quarter had two months with better numbers than last year.

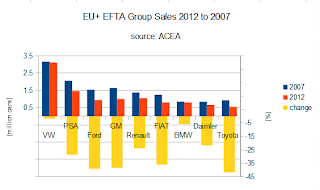

Of course, the sales increases did not affect all car manufacturers the same way and PSA, GM, and FIAT lost between 6.7 percent and 11.3 percent in the first nine months. Two of these sell their cars primarily in Europe and the same goes for GM's Opel/Vauxhall brand. Of these only GM achieved better sales this September. The firms were also among the hardest hit overall (from 2007-2012):

Additionally the improvements of course have to do with the ongoing discount battle in the automotive industry. The discount index of the CAR institute (German) reached an all time high in September in Germany. According to the same institute (German) Ford Europe loses over €850 with each sale (EBIT per car) and Opel/Vauxhall €414. Both PSA and FIAT also lose money. Still the losses per car are lower than a year before for every Group but Renault. The German premium car producers earn between €2000 and €3500 per car, and Porsche makes a profit of over €16.000 per sale.

So, the registrations have significantly improved in the third quarter, but this has come at the cost of a discount battle that is clearly not healthy for the whole industry. Even worse, the companies which primarily sell their cars in Europe are still not seeing any improvement in their sales figures. Still, the third quarter was the first one in years, where it seemed likely that the negative trend has stopped. Of course it had to happen at some point since the cars on the road in Europe were getting older and older, but this is good news nonetheless.

[The problem here will be that European officials will jump on these figures and pretend it was their doing, while completely forgetting about the disaster they have caused in the last four years.]

No comments:

Post a Comment